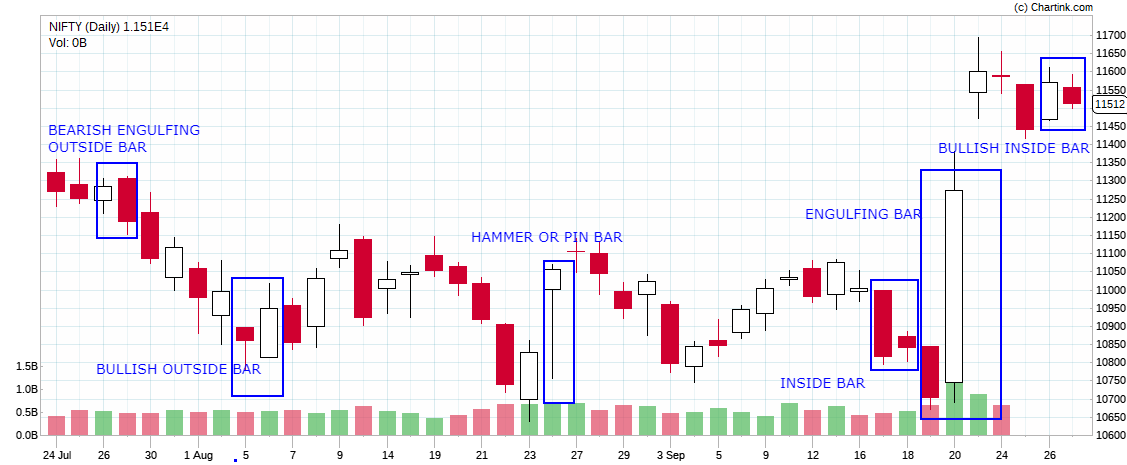

CANDLESTICKS IDENTIFICATION- Online Stock Market Training @ NCFM Academy Hyderabad

Bearish Engulfing Candlestick Pattern :

Bearish Engulfing – Trading Psychology:

Description

Widely regarded as one of the most common and effective bearish candlestick patterns.

It is a Top Reversal pattern depicted by 2 candlesticks.

The 1 st candle is a bullish candle that forms at the top of an uptrend.

The 2nd candle that forms initially “gaps” upwards before reversing into a long bearish candlestick that totally engulfs the 1st candle’s real body and closes below it.

Trading Psychology :

The Bulls are running the show with Price moving upwards indicating the continuation of the uptrend shown by the 1st candle.

As shown in the 2nd candle, a “gap” away from the upward move means that there is a sudden increase in a conviction of the Bulls to push the price further up.

However, the conviction suddenly stalls and reverses direction with the Bears making a challenge to reverse the trend.

The reversal of sentimental in the opposite direction is so strong that price gradually extends downwards, beyond the 1st candlestick’s real body.

Price is on its way down.

My Thoughts :

The Bearish Engulfing candlestick pattern is a highly reliable candlestick pattern for reversing an uptrend.

The wider the “Gap” and the longer the real body of the 2nd candlestick extends as compared to the 1st candlestick, the stronger the sentiment for the trend to reverse.

However, do note is that in Forex Trading, since it is being traded 24 hours, “Gaps” between the closing price and opening price are very rare, unlike other financial markets.

That is why when identifying such patterns in stock market trading, we can ignore the “Gap” portion of the candlestick pattern.

However, even though this particular bearish candlestick pattern is highly reliable, my advice is still not to take all the signals that come for granted, watch what price is doing first, Price Action precedes all indicators and patterns.

Learn more about Online Stock Market Training @ NCFM Academy Hyderabad.