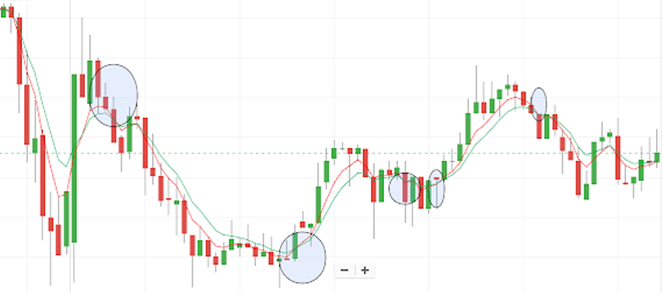

This is the simple strategy that uses 5 EMA and 8 EMA indicators.

Best works in Trending Markets, and worst in non-trending markets. Here’s How this strategy works:

If the faster EMA (5 EMA) crosses the slow EMA (8 EMA) to the upside then its sign of an uptrend.

If 5 EMA crosses 8 EMA to the downside, Its a sign of a downtrend.

Trade entries are taken following the EMA cross-over

Indicators: 5 EMA and & 8 EMA

Time frame: Any TF

Strategy: You can use this strategy for any Stocks, Forex and Commodities.

Buying Rules: Wait for 5 EMA to cross 8 EMA to the upside. Buy at the close of the candlestick that close after the EMA’s has crossed.

Selling Rules: When 5 EMA crosses 8 EMA to the downside, sell at the close of the candlestick.

TAKE PROFIT :

your profit to be set at least three times the risk on that trade

or you can target to take profit at the previous SL (Swing Low) for a sell order and a previous SH(Swing High) for a buy order.

HOW TO MANAGE A PROFITABLE TRADE:

How to manage a profitable trade with the 5 EMA and 8 EMA crossover strategy? Well, Maybe you can use:

If trade moves in your favour and you want to lock in profits, the best option is to move stop loss and place behind the high(or low) of each subsequent candlesticks that forms. That means

For a short trade, move SL (Stop Loss) and place above the high the candlestick that continues to make LH (lower highs).

For a long trade, move SL (stop loss) and below the low of each subsequent candlestick that continues to make HL (Higher Lows)

Or if on the DTF (daily time frame), you may try to use a 50-80 point trailing stop.

If on the 4 hr time frame, use 25-40 point trailing stop.

ADVANTAGES:

This is a simple easy to understand, where the beginner will find easy to use

In very strong trending markets, you stand to make lots of profits when you ride out the trend. Truly a trend is your friend here.

DISADVANTAGES :

This strategy performs very badly in the non-trending market.

If you trade LTF like the 4hours and daily, your stop-loss is going to be huge,

which means your risk is going to be big, so you have to trade small lots to keep your risk within your acceptable levels.

EMA are lagging indicators, and so, every entry taken based on MA is effective “late”, which means that price had already made a big move and you would not have entered into the trade at the start of the movie.

Therefore, by the time this strategy delivers the signal to enter, the market may be due for a temporary reversal and maybe hit your stop loss.